Chartered Accountants Ireland Budget 2025

Budget 2025 was delivered today against the backdrop of continued pressures on household budgets, but also with one eye squarely on securing votes in the upcoming General Election by putting more money in taxpayers’ pockets. The raft of measures includes…

Revenue outlines key taxation measures in Budget 2025

Revenue has outlined the key taxation measures in the Budget Statement delivered by Finance Minister, Jack Chambers on Tuesday, October 1.

McGowan Accountancy Services analyses Budget 2025

McGowan Accountancy Services has analysed Budget 2025, which was delivered in the Dail today, Tuesday 1st October by Finance Minister, Jack Chambers.

McGowan Accountancy Services U-14 Girls Championship

The Roscommon LGFA U-14 Girls Championship sponsored by McGowan Accountancy Services concluded last weekend. Three venues, Castlereagh, St. Faithleach’s and St Croan’s hosted the finals in near perfect weather conditions. Four Roads, Boyle, St. Faithleach’s, St. Dominic’s, Oran, Western Gaels,…

Accountancy & Business Grinds

Nuala McGowan, CPA / ACA, founder of McGowan Accountancy Services, specialises in giving Accountancy and Business Grinds to Secondary and Third Level students.

Specialist advice for the farming community

McGowan Accountancy Services has many years experience working with the farming community and is a specialist in the preparation of farm related accounts.

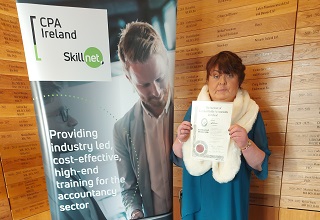

Dual designation

Following the amalgamation of CPA Ireland and Chartered Accountants Ireland, Nuala McGowan, founder of McGowan Accountancy Services has the dual designation of CPA / ACA.

Chartered Accountants Ireland and CPA Ireland amalgamate

Chartered Accountants Ireland and CPA Ireland have amalgamated with effect from September 1.

Best wishes to St. Barry’s Under 16 Girls in the semi-final

Best wishes to St. Barry’s Under 16 Girls who are playing in the semi-final of the championship on Tuesday night.

Good luck Girls

Good luck to the St. Barry’s U16 Girls team that take on St. Michaels / Ronan’s in the quarter final of the Championship on Tuesday night in Tarmon at 7.00pm.