An Increased Cost of Business (ICOB) Grant for small and medium sized businesses is now available funded by the Department of Enterprise, Trade and Employment.

An Increased Cost of Business (ICOB) Grant for small and medium sized businesses is now available funded by the Department of Enterprise, Trade and Employment.

McGowan Accountancy Services has sponsored a set of jerseys for the Tarmonbarry / Scramogue Community Games Under 15 Indoor Soccer team.

You do not have to make a will, but you are strongly advised to do so. If you want to have a say over who inherits all or part of your estate, you should make a will.

When filing your annual Form 11 tax return, or Form 12 if you are a PAYE worker, it pays to employ the services of a reputable financial company.

McGowan Accountancy Services are proud sponsors of St. Barry’s Ladies GAA.

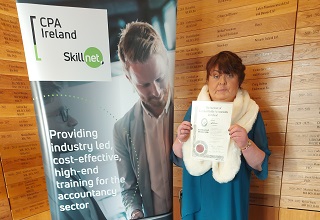

Nuala McGowan, founder of McGowan Accountancy Services is in the news this week after qualifying as a Certified Public Accountant.

McGowan Accountancy Services has a wealth of experience working with companies operating in the construction industry.

The Finance Bill 2023 introduced a temporary one-year Mortgage Interest Tax Credit.

The interest rate on tax debt frozen since the pandemic has been cut to 0%.

Revenue has published a range of statistics on PAYE for 2023. These statistics show that over 472,000 PAYE Income Tax Returns have been processed for 2023, an increase of almost 30% on the same period last year. Approximately 275,000 of…